New Year’s Resolutions 2022

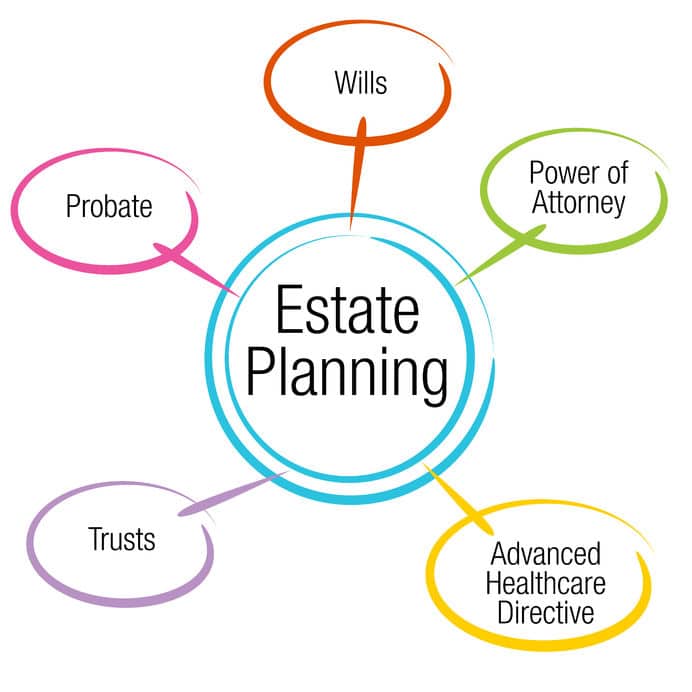

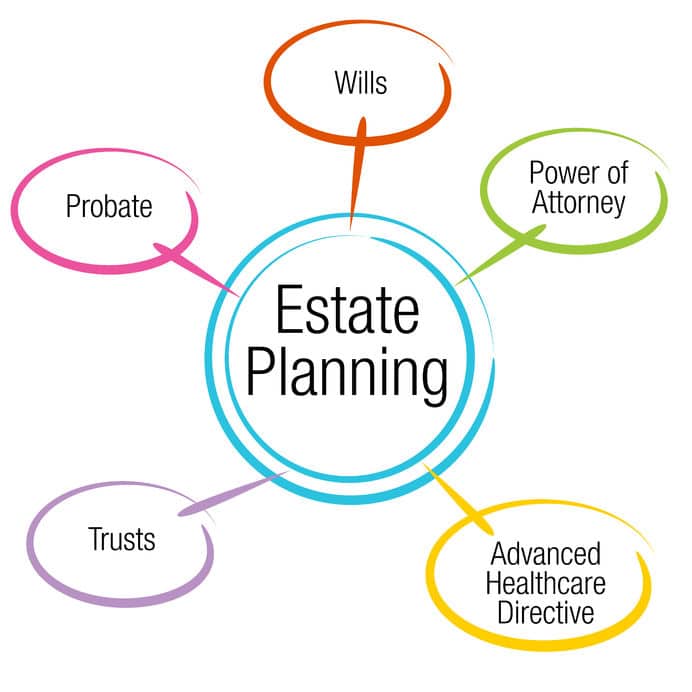

Thinking about how to start off the New Year responsibly? Take control of your personal affairs by completing your estate planning. The past two years

We offer the option of consultations and meetings in-person, video & phone.

Thinking about how to start off the New Year responsibly? Take control of your personal affairs by completing your estate planning. The past two years

Many people are unaware that a holiday gift splurge may actually be even more expensive than originally anticipated. The Internal Revenue Code imposes up to

The death of a loved one is a difficult time. The administration of the Estate of the person can make the death that much more

The 2021 Federal Estate Exemption is $11.7 million dollars for individuals and $23.4 million dollars for married couples. The exemption amount is a result of

Similar to a Financial Power of Attorney, a Medical Power of Attorney, sometimes referred to as an Advanced Health Care Directive, allows a person (“principal”)

A Financial Power of Attorney, sometimes referred to as a Durable Power of Attorney, is another critical piece of a well-structured estate plan. The Financial

A pour-over will accompanies a revocable living trust in a well-crafted estate planning portfolio. The purpose of a pour-over will is to “catch” assets that

Probate is a lengthy and expensive process that is governed by the California Probate Code, involving Court oversight of the distribution of a decedent’s estate.

In the field of estate planning, we’ve witnessed a shift in the way many of our client’s plan. Daily uncertainties remind us that it is

A Grantor Retained Annuity Trust (“GRAT”) is an irrevocable trust that is used to allow an individual to pass highly appreciating assets to his or